The adhesive industry is booming, and that trend likely will continue, according to most industry experts. According to a Business Insider's report, most researchers expect the market to increase by 60 percent from the final 2016 number of $7.39 billion to over $12 billion by 2023. This translates to a compounded annual growth rate (CAGR) of 7.3 percent.

Asia and South American appear to have the most potential for growth, due to the increase in nonwoven and packaging applications in these two regions.

What Are Hot Melt Adhesives?

Hot melt adhesives are thermoplastic materials comprised of stabilizers, additives, pigments and polymers, which are sold in the form of solid, cylindrically-shaped sticks or pellets. The sticks are melted and applied using a hot melt gun or sprayer.

Volatile Organic Compounds (VOCs)

Volatile organic compounds (VOCs) are organic chemical compounds that get volatized or released into the atmosphere during the manufacturing process. There is increased regulatory concern across the globe regarding VOCs and the effects on health and the environment.

A key market advantage for hot melt adhesives is that they are not considered VOCs.

Components of Hot Melt

Hot melt consists of three primary parts: high molecular weight polymer, a tackifier and a plasticizer.

- The polymer acts as the primary adhesive.

- The tackifier or resin provides more adhesion and the wetting properties.

- The plasticizer (wax or oil) controls the viscosity and the ability for small machinery to easily dispense it.

Types of Polyolefins

The most common type of hot melt adhesive is the ethylene vinyl acetate (EVA) variety. Styrene-butadiene is the second most popular. Other categories include polyamide, thermoplastic polyurethanes and polyolefin (PO), in addition to a few more described below.

Overview of Different Types

EVA

EVA adhesive is the most frequently used hot melt and is very versatile. The manufacturers use the type and amount of wax and resin to control the set time and tack.

Polyolefin (PO)

Polyolefin is a good, general purpose adhesive. It has only moderate temperature resistance, excellent thermal stability and resistance to grease and oil.

You can use it on porous substrates, but it will remain relatively rigid.

Amorphous polyolefin (APO)

Amorphous polyolefin is very inexpensive and has excellent resistance to acids and fuels. Like polyolefin, it has moderate heat resistance. The texture of the adhesive is soft, tacky and flexible. It provides you with longer open times than most of the hot melts and blends well with other polymers.

Styrene Block Copolymer (SBC)

SBC has a very high resistance to heat, sets fast and blends well with other polymers.

Metallocene polyolefin (MPO)

This can be used in a wider temperature range than EVA. It is clear and odorless and has excellent thermal stability with fast set times.

Thermoplastic Polyurethane (TPU)

Thermoplastic polyurethane is a resin-type of hot melt, with good elasticity, transparency and resistance to oil, grease and abrasion.

Most industry analysts expect thermoplastic polyurethane to increase market share the fastest due to its overall properties.

What Companies Produce Hot Melts?

Six companies hold a large portion of the market share in hot melt adhesive production: Dow Chemical, 3M Company, Avery Dennison, Henkel, Sika AG and H.B. Fuller.

Most analysts expect further industry consolidation in 2018 and beyond.

Solvent-Based Adhesives

Solvent-based adhesives have traditionally been used in the automotive, furniture and construction industries. The base liquid used to dissolve the polymer that forms the adhesive bond uses a solvent.

Depending on the type of solvent used, you may need to apply the solvent-based adhesive with a brush, roll, spray or something else. Some solvents are flammable, and many are poisonous, and cleanup and handling require special precautions.

Solvents evaporate quickly, and cleaning up after using it may require special methods.

Environmental Problems With Solvent-Based Adhesives

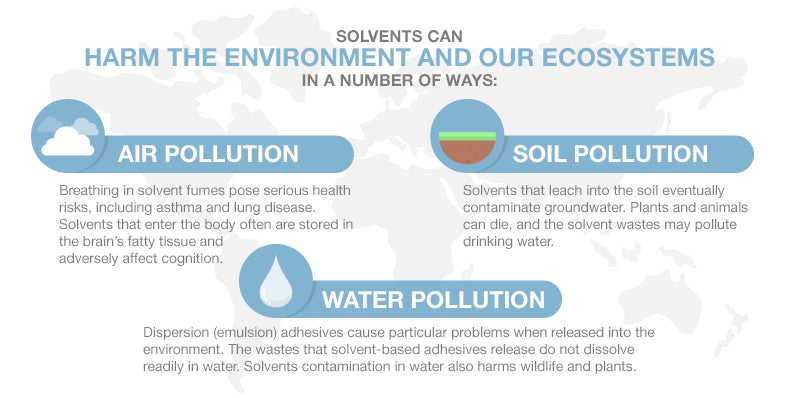

Solvents can harm the environment and our ecosystems in a number of ways:

Soil Pollution

Solvents that leach into the soil eventually contaminate groundwater. Plants and animals can die, and the solvent wastes may pollute drinking water.

Water Pollution

Dispersion (emulsion) adhesives cause particular problems when released into the environment. The wastes that solvent-based adhesives release do not dissolve readily in water. Solvents contamination in water also harms wildlife and plants.

Air Pollution

Breathing in solvent fumes pose serious health risks, including asthma and lung disease. Solvents that enter the body often are stored in the brain’s fatty tissue and adversely affect cognition.

Hot Melt and the Environment

Hot melt does not contain solvents. Hot melt uses water to dissolve the polymer. This is another reason why many different sectors are switching to hot melt from solvent-based products.

Hot melt produces minimal pollution and has little-to-no environmental effects. Unlike adhesives with solvents, you don’t need any special ventilation, nor are they flammable. The price point is very low, so for industries like construction and packaging with high-volume operations, it keeps costs down.

Hence, governments, regulatory agencies and environmental organizations all support the use of hot melt over solvent-based products. The favorable policies enacted by governments around the world will continue to help increase the use of hot melt, which is expected to grow its market share at the expense of solvent-based adhesives.

Other Advantages of Hot Melts

The superior bonding of hot melt adhesives, along with the adhesion abilities and speedy applications, make hot melts particularly useful for multi-functioning packaging applications.

Hot melt has a much longer shelf life than solvent adhesives.

Asian Markets

India and China are very likely high-growth markets for the use of hot melt adhesives. The furniture and construction industries, coupled with continuing investments infrastructure and manufacturing, is expected to fuel adhesive industry growth there.

The furniture and construction industries have experienced strong demand in 2016 and 2017, with that trend forecast continuing. Hot melt has become a staple for use in these sectors.

South America

The total value of the hot melt adhesive market in South America reached over $101 million in 2015. The expected market value in the next two years is $149 million, a CAGR of almost 8 percent.

The main growth regions for hot melts will be in Brazil, due to its robust manufacturing sector, along with Mexico, Argentina, Columbia and Chile. The primary market segments include packaging, automotive, electronics, textiles and footwear.

The USA

In 2015, the hot melt market in the United States was valued at $6 billion. Researchers expect that number to reach at least $9.4 billion in the next five to six years. That is an average CAGR of 5.2 percent through 2024.

Europe

Revenue in Europe for hot melts is expected to reach close to $2 billion in 2018. Industry prognosticators believe this CAGR of 5.52 percent annually will continue through 2023.

The packaging and paper industries account for 30 percent of the adhesive market share in Europe and most other locations. Healthcare and transportation have the next largest share of the market.

Germany dominates Europe as the most prominent user of hot melt adhesive, with a share of over 23 percent. The UK is expected to be the fastest growing sector in 2018 through 2023, with a predicted CAGR of greater than 6.2 percent.

Automotive Sector

The hot melt industry in China will see the most growth in the automotive sector. Vehicle manufacturing uses hot melt for a wide range of applications. Since hot melt properties include resistance to weather and chemicals, the usage is particularly attractive in cars and trucks. Vehicle companies use hot melt for seat upholstery, exterior trim bonding, door sealants and much more.

Amorphous poly-alpha-olefin hot melt adhesive is the most popular for vehicle use as it also has a high UV protection rating. Globally, this sector will see an increase in hot melt adhesive use, but China’s expanding vehicle manufacturing will increase hot melt usage there for the next 5-6 years. Experts expect revenues in China to reach $50 million by 2024.

Construction

The construction industry has relied on solvents for adhesives needs for decades. Hot melt has begun to replace solvent-based products. Construction is one area that industry watchers predict hot melt use will rapidly grow, outpacing the expected growth in other industries

Packaging

As a major endues market for hot melt adhesives, the packaging industry, hot melt will continue to expand and grow with packers. Industry watchers state that by 2024, the hot melt revenue in the packaging industry only will reach $3 billion worldwide, with a CAGR of 5.5 percent per year for each year, which began in 2016 and will continue through 2017, 2018 and beyond.

Smaller consumer food packs, due to a larger number of one- and two-person households will also drive up the need for hot melt.

Pressure Sensitive Adhesives (PSA)

Diaper closing tape represents a large portion of the pressure sensitive adhesive, hot melt market. Aircraft interiors, too, need pressure sensitive adhesives.

Over the next five years, experts predict disposables will account for $1.6 billion in revenue for the hot melt market.

The worldwide market in baby diapers, adult incontinence and feminine hygiene products has increasingly driven governments to enact strict disposal regulations and laws. Hot melt adhesives remove much of the disposal problem for the manufacturers. Most remain extremely optimistic for the next five years and beyond for the use of hot melts by this industry sector.

Printing Industry

The regulatory environment today has resulted in requiring more information displayed on labels. Demand for print labels using hot melt adhesives will, accordingly, likely increase in 2018 and beyond.

Booklet labels, labels that require you to peel away the top layer to reveal the text related to the contents of a box, package or item, will need adhesives. Hot melt meets these needs without any environmental worries or problems with application.

Many advertisers have been marketing through labeling. This trend will likely continue, increasing revenue for hot melt products in this market.

Effect of the Growing Corporate Responsibility Movement

Businesses small and large have come under increasing pressure to do business in an environmentally responsible manner. This trend significantly increased in 2017 and is very likely to continue for the foreseeable future.

Switching to hot melt, or finding ways to use hot melt in place of solvents or for bonding purposes done by some other method, is an easy and cost-effective way for enterprises to demonstrate a commitment to the environment.

Hot melt insiders believe that companies will find as-yet-unrecognized uses for hot melt, given how non-polluting hot melt adhesives are.

Bio-Based Production

Several companies, including 3M Company in partnership with H.B. Fuller, have been focusing on developing bio-based hot melt adhesives. Using bio-based production methodologies in production will help further cement the corporations’ market shares in the hot melt market.

Coat Weight

Coat weight is the amount of adhesive used per item for bonding with something. Companies that manufacture adhesive dispensing systems, such as pneumatic glue dispensers, have several tools and options that lower the coat weight of the hot melt.

This trend has been noticed across all hot melt industries including packaging, labeling and construction. This will affect demand, driving it up in some instances, due to the relatively low cost of hot melt, especially when compared to other adhesives.

Possible Inhibiting Factors for Hot Melt Industry Growth

The market volatility for raw materials could adversely affect the growth of the hot melt sector. Increases in the prices for natural polymers, such as asphalt, rubber and starch, could drive up prices for hot melt products.

The fluctuations of oil prices can also have a considerable effect on hot melts. Bitumen natural rubber and resin, the polymeric material used by hot melt producers, prices will rise along with any increase in oil costs.

Final Thoughts

The few market-inhibiting factors that could reduce the optimism of most analysts for hot melt’s future in 2018 and beyond appear negligible. Most oil industry analysts, for example, predict a downturn and flattening of oil prices to levels slightly below 2017 prices. This bodes well for the rosy picture of the hot melt adhesive industry’s future.

Finally, industry futurists believe that other uses for hot melt will be discovered and exploited to further bolster the analyst’s claims of steady, substantial growth.